CHECKALT IS A LEADING ONLINE BILL PAYMENTS, REMITTANCE PROCESSING, AND RECEIVABLES PROVIDER.

Partnership illustrates shared vision to reduce friction in payments systems and empower businesses with the next generation of faster, digital payments.

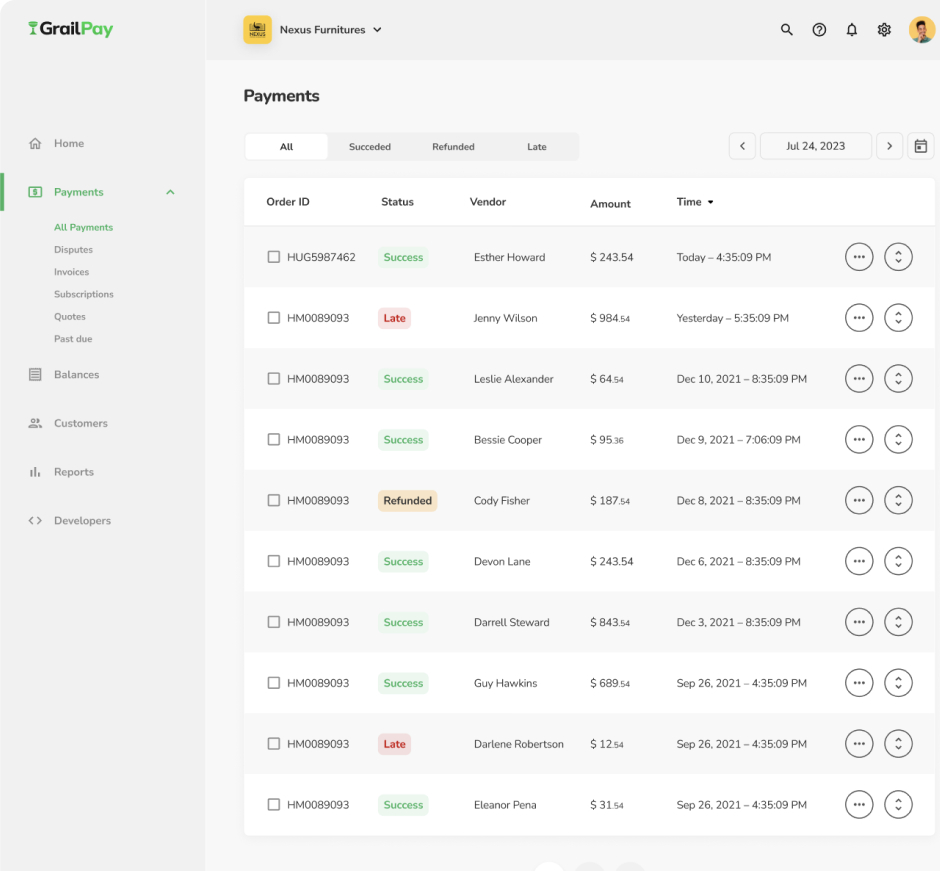

NEW YORK, N.Y. – April 2, 2024 – GrailPay™, a leading provider of payments and data solutions for payment gateways, facilitators, and processors, proudly announces its latest strategic partnership with CheckAlt™, a premier player in the financial technology and payments space that simplifies complex payment flows regardless of payment channels or types. This collaboration is aimed at bringing a full stack of data, risk, and payments services to CheckAlt’s base of bank, fintech, and payment partners.

GrailPay has debuted state of the art authentication, embedded financing, and risk management solutions, establishing itself as a pioneer in the payments industry. Through the use of open banking data, GrailPay is able to offer CheckAlt partners the opportunity to reduce risk of transactions with real-time balance and transaction data. Additionally, GrailPay is offering CheckAlt a full suite of risk management solutions to mitigate risk on ACH and check payments. This partnership will deliver critical risk mitigation functionality designed to support CheckAlt’s highly valued partners.

William Messina, CEO of GrailPay, explained: “We are thrilled to collaborate with CheckAlt to deliver cutting edge tools for their check and ACH capabilities. This partnership illustrates our shared vision to reduce friction in the payments system and empower businesses with the next generation of faster, digital payments.”

Core benefits of the CheckAlt partnership with GrailPay include:

- Real-time account validation provides verification of account details and balance in real-time, enhancing the digital payments experience.

- Open banking data facilitation of bank transaction data to reduce costs and friction over check and ACH payments.

- Risk and fraud monitoring solutions on check and ACH payments to mitigate fraud and friction over bank payments.

“We’re excited to join forces with GrailPay to enhance our online payment capabilities,” said Patrick Law, COO of CheckAlt. “Their real-time verification solution is a perfect fit with our upcoming Online Payments product launch, allowing us to deliver a secure and seamless checkout experience for our customers. By leveraging GrailPay’s expertise, we can further differentiate ourselves in the market and offer unparalleled value to our clients.”

About CheckAlt, LLC:

As an experienced provider of lockbox processing solutions, CheckAlt processes both paper and electronic payments for approximately 1500 clients nationwide. CheckAlt thrives at the convergence of payments; we pride ourselves on our full suite of item and payment processing solutions which address all major payment methods across all deposit channels, while focusing on additional value-added services specific to aggregation, automation, and the acceleration of payments. To learn more follow us on LinkedIn or send us a message at LinkedIn.com/company/CheckAlt.

About GrailPay:

GrailPay provides infrastructure for payment companies and software providers to offer embedded risk, finance, and payment solutions to business clients. GrailPay’s technology empowers partners to validate bank accounts and onboard clients to ACH seamlessly. With this infrastructure, GrailPay partners can offer revenue-generating products that minimize risk and enhance cash flow, driving monetization and retention over existing payments volume. For more information, please visit www.grailpay.com.

# # #

CONTACT INFORMATION

William Messina | CEO

Email: William Messina <[email protected]>

Direct: 941.323.7182

HQ: 447 Broadway, Floor 2, New York, NY 10013